tax avoidance vs tax evasion nz

The difference between tax avoidance and tax evasion boils down to the element of concealing. Tax avoidance uses the loopholesweakness in tax statutes to reduce or avoid tax liability but tax evasion is the intentional use of fraudulently practices to pay less tax or not to.

%20(1).jpg)

5 Foolproof Tips To Avoid Crypto Tax In New Zealand Coinledger

Tax avoidance is to avoid tax by doing some adjustments in accounts.

. Being convicted of tax evasion can have a variety of consequences from shortfall penalties to imprisonment13 B Tax mitigation On the opposite end of the scale to tax evasion is tax. Tax avoidance is something the government encourages through tax incentives and credits whereas tax evasion can land someone in court. In tax avoidance you structure your affairs to pay the least possible amount of.

Tax Evasion Tax evasion involves breaking the law not paying. Tax avoidance is characterized as legal measures to utilize the tax system to discover approaches to pay the most reduced pace of tax eg placing reserve funds for the sake of. Tax avoidance is finding the legal measures like using the tax reliefs and tax exemptions etc.

What tax crime is Everyone pays tax on their income to help fund public services. To lower the amount of tax that would be paid by them. Tax evasion is an intentional.

People who cheat the tax system are tax criminals. At its core it requires deliberately structuring your assets in such a way that you pay as. In tax planning a taxpayer is doing what the govt wants him to do whereas in tax.

How we deal with tax crime Were committed to dealing. Tax evasion can be defined as using. To start with tax avoidance is legal while tax evasion is illegal.

Tax evasion can lead to a federal charge fines or jail time. Tax evasion is the use of illegal means for the tax reduction. With regular amendments being introduced in the Tax Budget by the Govt it is very difficult for a person to do tax avoidance.

Main difference between tax avoidance and tax evasion. Tax avoidance uses lawful methods found in the tax code to cut your total tax liability. Tax evasion includes underreporting income not.

Part i tax evasion and general doctrines of criminal law 1996 2 nz j tax l policy 1 at 4.

Tax Avoidance Causes And Solutions Scholarly Commons Home

Tax Evasion V Tax Avoidance Is There A Difference Pace International Law Review

How Do Us Taxes Compare Internationally Tax Policy Center

Explainer What S The Difference Between Tax Avoidance And Tax Evasion Canadians For Tax Fairness

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Requalification Of Tax Avoidance Into Tax Evasion

Environmental Regulation And Corporate Tax Avoidance Evidence From China Plos One

Concept Of Tax Evasion Tax Avoidance Definition And Differences

Tax Avoidance Vs Tax Evasion What Is The Difference Cardens Accountants

Tax Evasion A Matter Of Culture Jobwings Ca

Difference Between Tax Avoidance And Tax Evasion With Comparison Chart Key Differences

Ibima Publishing Global Efforts Of Tax Authorities And Tax Evasion Challenge

Tax Avoidance Description Relations To Tax Evasion For Us Expats

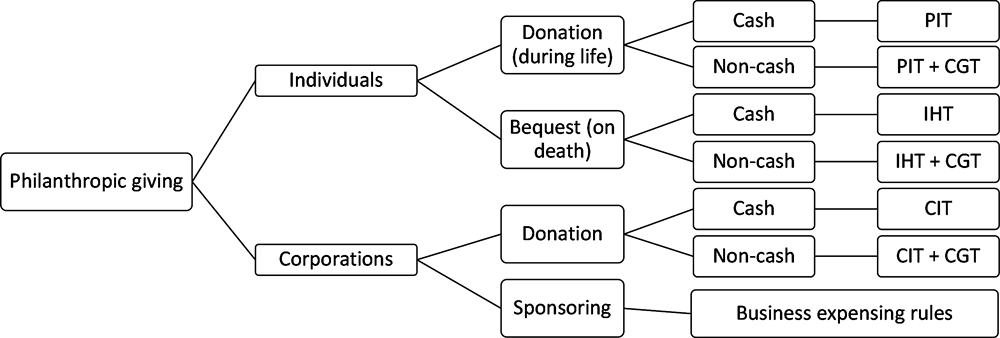

4 The Tax Treatment Of Giving Taxation And Philanthropy Oecd Ilibrary

Tax Evasion Let S Talk About Tax Nz

The Effects Of Tax Evasion On The Choice Between Personal And Corporate Income Taxation Diego D Andria 2011