charitable gift annuity canada

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Registered charities can offer a charitable gift annuity in which they can use a portion of a donation of say 100000 to buy a life annuity from a top-rated insurance company.

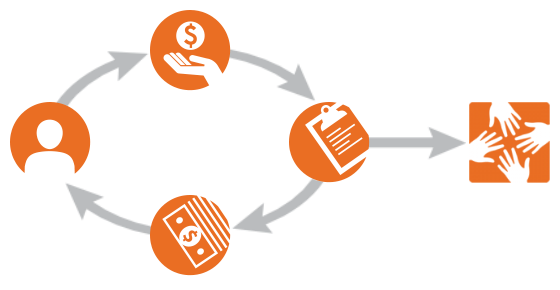

A Charitable Gift Annuity Agreement is an arrangement whereby an individual or individuals make an irrevocable gift to a charitable organization in return for which they receive a guaranteed.

. Request your free illustration today. Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Also known as Gift Plus Annuities A gift annuity allows a donor to make a gift in most cases receive a generous charitable tax receipt and receive an annual tax-free payment an.

Bank of America Private Bank Is Here to Help with Your Philanthropic Goals. To learn how a Charitable Gift Annuity or other planned gift can leave a lasting legacy please contact us. Ad Read About Charitable Habits of the Affluent in the Bank of America Philanthropy Study.

It Can Also Provide You With A Fixed Income Stream For The Rest Of Your Life. A Charitable Gift Annuity is a gift vehicle and when combined with a Gift Funds Canada Donor Advised Fund enables a donor to make a charitable gift during their lifetime. At the end of life the remainder of your annuity capital becomes a gift for your favourite charities Let us help you get started.

It has two parts. Ad Read About Charitable Habits of the Affluent in the Bank of America Philanthropy Study. You can discuss this confidentially by 1.

Denise Williams 1-800-BANTING 226-8464. Ad Support our mission while your HSUS charitable gift annuity earns you income. Create a Legacy with aCharitable Gift Annuity.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Charitable gift annuities are an attractive option. 11 Little-Know Tips You Must Know Before Buying.

Ad Get this must-read guide if you are considering investing in annuities. Coordinator Legal Affairs Legacy Gifts For more information about making a gift through charitable gift annuities. A Charitable Gift Annuity is a gift vehicle that when combined with a Gift Funds Canada Donor Advised Fund enables a donor to make a charitable gift during their lifetime.

Or call the Stewardship Planned Giving department 1-800-619-7301. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. They allow you to give immediate support to Golf Canada Foundation while ensuring a secure income stream for your lifetime.

Charitable Gift Annuities A charitable gift annuity is an attractive way for individuals aged 70 years and older to make a donation to Arthritis Society Canada while receiving a. Ad True Investor Returns with No Risk Find Out How with Your Free Report Now. An annuity is an irrevocable gift to a charity like JDRF Canada in return for which you receive a guaranteed regular annual income for life.

Charitable Gift Annuities CGAs work the same way as regular commercial annuities but offer even more advantages because of a charitys tax-free status. Charitable Gift Annuity. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals.

A charitable gift annuity to benefit the Catholic organization s of your choice is a generous expression of your support for the Catholic. Howe Institute while providing a secured income stream for the donor during their lifetime. Dont Buy An Annuity Until You Review Our Top Picks For 2022.

A charitable gift annuity is a way to donate to a nonprofit and receive a stream of lifetime payments in return. Ad Establish A Charitable Gift Annuity To Help Support Girls Around The World With Plan USA. A charitable gift annuity provides an immediate gift to CD.

Payment rates depend on several factors including your age. A charitable gift annuity is an arrangement under which a donor transfers a lump sum to a charity in exchange for fixed guaranteed payments for the life of the donor andor. Depending on the donors age this.

Explore income and tax benefits of an HSUS CGA. As with any other. Additionally you will receive a charitable tax receipt for the.

A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity.

Link Charity Canada Inc Linkedin

Ways Of Giving Charitable Gift Annuities The Presbyterian Church In Canada

Charitable Annuity Benefits Of A Charity Gift Annuity Link Charity

Http Www Valamohaniyercharitabletrust Com Annadan Html Free Food Providing Functions Are Every Month Amavasai Trust Words Charitable Charity Organizations

Charitable Annuity Benefits Of A Charity Gift Annuity Link Charity

Ways Of Giving Charitable Gift Annuities The Presbyterian Church In Canada

Charitable Gift Annuity Partners In Health

Charitable Donations Structuring Gifts With Passive Retirement Income Advisor S Edge

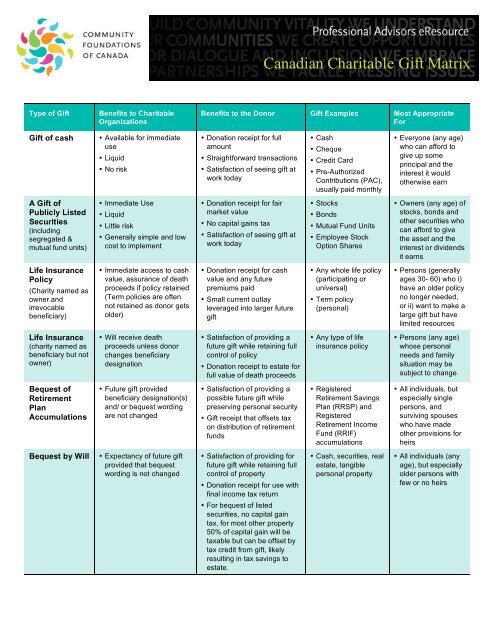

Canadian Charitable Gift Matrix Community Foundations Of Canada

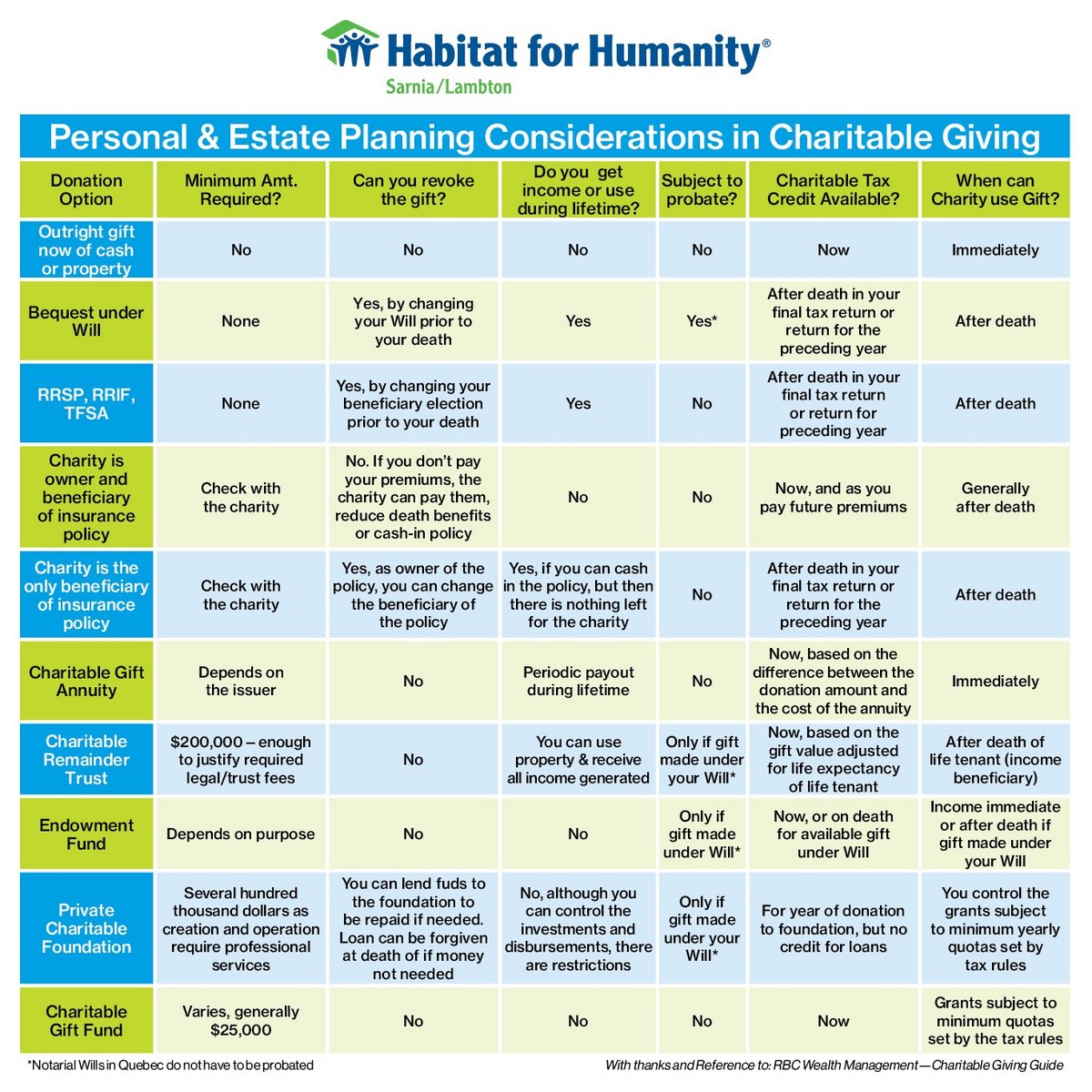

Planned Giving Habitat For Humanity Sarnia Lambton

Gift Estate Planning Sfu Advancement Alumni Engagement

Charitable Gift Annuities Citadel Foundation

Canadian Charitable Annuity Association

Charitable Gift Annuity The Christian School Foundation

Leave A Legacy Alzheimer Society Of Ontario